But where do we start? Initially, it could be as basic as learning about the SDGs and which one you care the most about. Mindful intake is the next action totally under your (Tyler Tysdal).

control and remit of direct actions. Partnership is vital and every stakeholder in society can contribute, including the individuals, investors, financial organizations, government, policymakers and regulators. This is regrettable. Our entrepreneurs can impact whatever that’s threatening our world and our lives. Tyler T. Tysdal. Yes, we’re looking at them with a sharp eye on their potential for effective impacts and high returns for our investors. Of course we are. The most crucial thing here is to release the wealth of potential they have to use.

And to create options that will reduce ecological destruction. To us, an individual is not a property. As soon as an entrepreneur satisfies our requirements, we’re all in. Even with a business design that promises strong returns, we think that tough numbers originated from a soft, individual touch – Tyler T. Tyler Tysdal. Tysdal. We invest our own wealth of experience in developing healthy, sustainable services: Providing our business owners with sage guidance; bringing innovation and company assistance to the table; partnering with our neighborhood of organisation resources; promoting development; helping our business owners expect change; and keeping them competitive.

If other investment business join the revolution, that’s a good thing. We are taking a look at extraordinary service opportunities, rethinking and reinventing economic models, consisting of financial investment portfolio building and construction. The lynchpin of our technique is to produce a digital magnet for deal flow. (More details on that coming soon.) Let’s simply say that we think our digital platform will be a design for cooperation.

As you might expect, we are approaching our work with a sense of urgency. We must seize the opportunities in front of us and develop our method out of the hazards that could take everyone down. We anticipate you are as worried as we are. Tyler Tysdal. (Picture credits: The Natural Step Canada; Steve Wilson; Simon Fraser University; Rural Knowledge Exchange; Duncan Hill).

Titlecard Capital Group

Impact investing has actually never ever been more popular nor more in danger. The field is wrecked by confusion over basic principles, suspicious practices that invite cynicism, and biases versus large companies. If more clearness is not brought to the motion, it risks a tough fall. The stakes are high, and the world does not have a surplus of cash or time to invest.

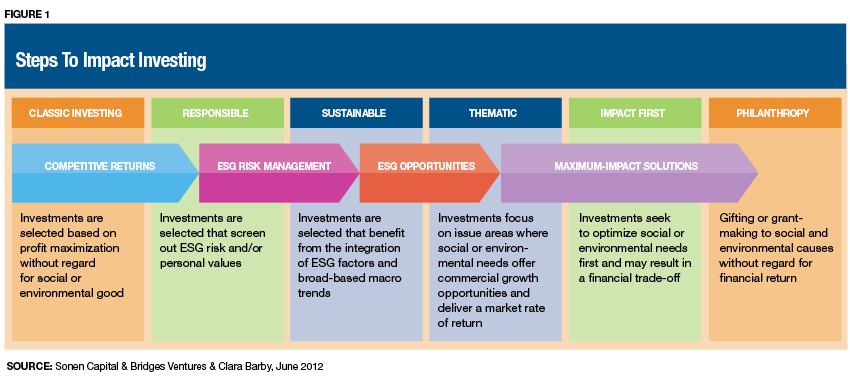

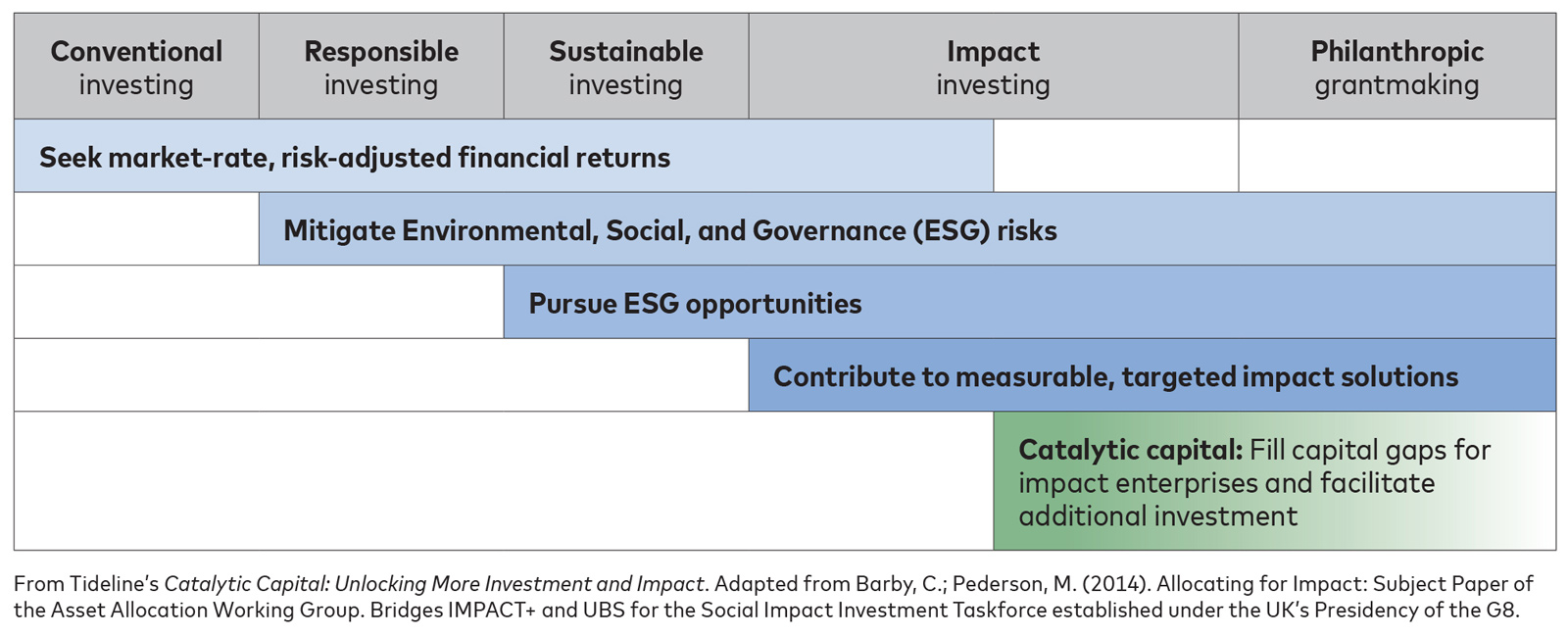

Impact investing can help, however only if appropriately harnessed. A handful of prevalent problems are responsible for the majority of the trouble: Muddled thinking about proper rates of return that saps resources and worsens in-fighting amongst practitioners. Questionable theories of impact that generate confusion about the character and quality of evidence to show impact, even handling to obscure the value of standard investment and financial growth.

To get rid of these obstacles, impact investors should follow 3 guidelines. The highest calling of impact investing is to increase the quantity of capital being invested in locations, business, items, and services that have substantial social benefits. Setting in motion personal capital circulations is made greatly harder if impact investors are not aligned with standard investors, who look for market returns.

Impact investors need to rather focus on growing competitive markets by lining up with market gamers who make decisions based upon the possibility of an investment accomplishing market rates of return. That probability (risk) notifies the financial investment’s price, which is the signal markets use to effectively allocate resources. Impact investors ought to not wish to alter the financial structure of a financial investment with a subsidy, as that would mask an investment’s true rate and motivating investors to make investments they would otherwise prevent. Tyler Tysdal.

It can result in the wrong factories getting built and the incorrect organisations getting supporta waste of funds and a missed out on opportunity to accomplish social gains. Instead of run the danger distorting markets, the distinct and differentiating mission of impact investors is to develop better, more competitive markets by investing non-concessionary capital in organisations with potentially large social benefits, such as reduced income inequality or slowed global warming.

Tree Lone Tree

Impact investors similarly understand, as Martin Wolf composes in his review of Colin Mayer’s book Prosperity, that ” profit is a conditionand result ofachieving purposes” (Tyler Tysdal). Understanding this is critical to impact investors’ capability to take advantage of their own financial investments with that of traditional investors. Offering concessionary capital (aids) is the task of federal governments and their companies.

Combined financing is the regard to art for governments determining the right mix of direct subsidies, warranties, tax relief and exemptions, or improved allowing environmentcode for the collection of guidelines, laws, and public bureaucracies with which services run. By virtue of their authority to tax and spend, federal governments have the standing to make these decisions.

The dangers of misallocations if impact investors do not anchor themselves to market returns are serious – Tyler Tivis Tysdal. The risks of misallocations if impact investors do not anchor themselves to market returns are major. Without a fiduciary-like focus on achieving market returns for their customers, fee-charging intermediariesadvisers, financial investment bankers, gatekeepers, and property managerseffectively receive a license to underperform and rationales for doing so.

The range reveals the wildly divergent meanings of asset ownership, asset allotment, and investees that fulfill reputable criteria. The finance market is left free to rush to develop specialized “impact” products, which frequently charge greater charges. Beware of consultants who get a client’s choice in between financial returns and social impact, specifically because of the troubles of properly measuring the latter.

They add to a frothy, do-good enthusiasm that is not grounded in well-tested, expert investing principles. In fairness, making market returns is challenging. Numerous businesses, and even entire sectors, do not. It is sadly true, as Mara Bolis and Chris West mention, that many enterprises impacting poor individuals in the international South make in the low single digits.

Prosecutors Mislead Money

Still, too numerous impact investors surrender to concessionary company designs before the battle for market returns is ever joined. They use a myriad of reasonings to validate accepting concessionary returns, arguing, for instance, that aids are essential because impact-oriented companies take a long period of time to become financially self-reliant. However accepting concessionary returns is a statement that one is not actually an investorimpact investing is investing, after all.

The element premiums, as they are called, go by terms such as value-growth premium, momentum premium, illiquidity premium, credit risk premium, and volatility premium. Impact investors using the aspect method have an obligation to clarify the attributes of impact financial investments that they believe will attain exceptional returns. Tyler T. Tysdal. This is not as hard as it may sound, specifically for impact investors who think that there is no trade-off between monetary returns and social benefits – Tyler T. Tysdal.